Every morning at Maple Grove Skilled Nursing Facility, Sarah arrives at 7:30 AM to tackle the same exhausting routine. She pulls up the list of 15 new admissions scheduled for the day and begins the tedious process of calling insurance companies to verify coverage. By 10 AM, she’s still on hold with the third payer, listening to the same elevator music she’s memorized over the past five years.

Sound familiar? If you’re nodding your head, you’re not alone. Manual insurance verification is draining administrative resources at SNFs across the country, with staff spending up to 45 minutes per patient just to confirm basic coverage details.

But what if there was a better way? What if you could reduce that administrative burden by 50-70% while improving accuracy and patient satisfaction at the same time?

The Hidden Cost of Manual Insurance Verification

Manual insurance verification isn’t just time-consuming: it’s expensive. Every minute your admissions coordinator spends on hold with Medicaid or calling private insurers is a minute they’re not processing new referrals or supporting patient care.

The typical manual verification process looks like this:

- Step 1: Pull patient insurance information from referral documents

- Step 2: Call the insurance company and wait on hold (average wait time: 8-12 minutes)

- Step 3: Navigate through automated phone systems

- Step 4: Speak with a representative to verify coverage details

- Step 5: Manually document findings in multiple systems

- Step 6: Repeat for secondary insurance, if applicable

This process consumes 20-45 minutes per patient, and that’s when everything goes smoothly. When there are complications: incorrect member IDs, outdated information, or complex coverage scenarios: the time investment can double.

For a typical SNF processing 8-12 new admissions daily, this translates to 3-6 hours of staff time spent solely on insurance verification. At an average administrative salary of $40,000 annually, that’s roughly $8,000-$16,000 in labor costs dedicated to a process that could be automated.

How Real-Time Insurance Verification Works

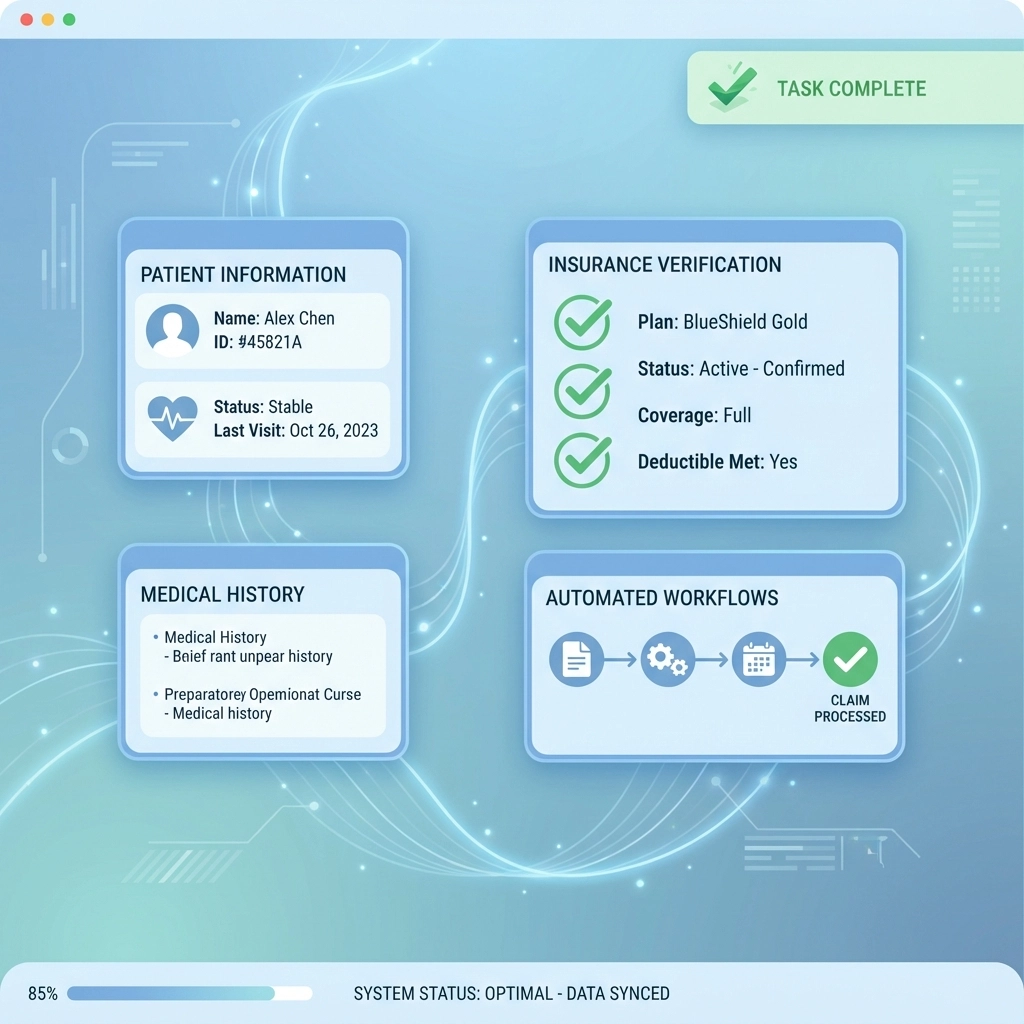

Real-time insurance verification leverages direct connections to payer databases to instantly retrieve patient eligibility and benefits information. Instead of manual phone calls and hold times, the entire process happens in seconds with a simple button click.

Here’s how the automated process works:

Instant Data Retrieval: When a referral comes in, the system automatically queries the patient’s insurance information against real-time payer databases. This happens in the background while your staff reviews other aspects of the referral.

Comprehensive Coverage Details: The system returns not just basic eligibility, but detailed benefit information including:

- Active coverage dates

- Copayment and deductible amounts

- Prior authorization requirements

- Covered services and benefit limits

- Secondary insurance coordination

Automatic Documentation: All verified information populates directly into your admissions workflow, eliminating duplicate data entry and reducing transcription errors.

Exception Handling: When the system encounters incomplete or conflicting information, it flags the case for manual review rather than leaving staff to discover problems during the admission process.

The 50-70% Administrative Time Savings Breakdown

The dramatic time savings from real-time insurance verification come from multiple efficiency gains working together:

Elimination of Phone Calls

The most obvious time saver is removing the need to call insurance companies entirely. This alone saves 15-25 minutes per patient verification. When you multiply this across 8-12 daily admissions, you’re looking at 2-5 hours of recovered staff time daily.

Batch Overnight Processing

Advanced systems can run insurance checks for all scheduled patients overnight, providing your team with a comprehensive eligibility report first thing in the morning. This allows staff to proactively address coverage issues rather than discovering problems during the admission process.

Reduced Data Entry

Real-time verification systems integrate directly with your EHR and billing platforms, automatically populating verified insurance information. This eliminates the need for staff to manually enter the same data multiple times across different systems, saving an additional 5-8 minutes per patient.

Fewer Billing Rejections

Accurate, real-time insurance verification significantly reduces claim denials due to eligibility issues. While this doesn’t directly impact admissions processing time, it reduces downstream administrative work by 30-40% as your billing team handles fewer rejection workflows and resubmissions.

Beyond Time Savings: Additional Benefits

While the administrative time savings are compelling, real-time insurance verification delivers benefits that extend throughout your entire operation:

Faster Decision Making

With instant access to detailed benefit information, your admissions team can make informed decisions about patient placement immediately. No more delays waiting for insurance verification to complete before accepting a referral.

Improved Cash Flow

Real-time verification helps identify coverage gaps or authorization requirements upfront, allowing you to address billing issues before they impact reimbursement. This can improve your average collection timeline by 15-20 days.

Enhanced Patient Experience

Patients and families appreciate transparent communication about coverage and costs. Real-time verification enables your staff to provide accurate financial information during the admission conversation, building trust and reducing surprised billing disputes.

Competitive Advantage in Referral Response

When hospital case managers are shopping referrals to multiple SNFs, response time matters. Facilities using real-time verification can provide complete admission decisions: including financial clearance: within minutes rather than hours. This increases referral conversion rates by 25-30%.

Implementation Considerations for SNFs

Rolling out real-time insurance verification requires thoughtful planning to maximize benefits and minimize disruption:

Integration Requirements

The most effective verification systems integrate seamlessly with your existing EHR and practice management software. Look for solutions that offer pre-built integrations with major SNF software platforms rather than requiring custom development work.

Staff Training

While real-time verification dramatically simplifies the insurance checking process, your team needs training on the new workflows. Plan for 2-3 training sessions to ensure staff understand how to interpret automated results and handle exception cases.

Data Quality Management

Automated systems are only as good as the data they receive. Establish processes to ensure referral information includes accurate insurance details, and train staff to verify member IDs and policy information when data quality issues arise.

Measuring Success

Track key metrics to quantify the impact of real-time verification:

- Average time per insurance verification

- Daily admissions processing capacity

- Billing rejection rates due to eligibility issues

- Staff overtime hours for administrative tasks

Calculating Your ROI

The investment in real-time insurance verification typically pays for itself within 3-6 months through administrative time savings alone. Here’s a simplified ROI calculation:

Current State: 3-6 hours daily spent on manual verification

Automated State: 0.5-1 hour daily for exception handling

Time Savings: 2.5-5 hours daily

Annual Labor Cost Savings: $15,000-$30,000

When you add the benefits of faster referral response, reduced billing rejections, and improved cash flow, the total value often exceeds $50,000-$75,000 annually for a typical 100-bed SNF.

Making the Change

The administrative burden of manual insurance verification is no longer a necessary evil in skilled nursing facility operations. Real-time verification technology has matured to the point where it’s reliable, affordable, and delivers immediate value.

The question isn’t whether automation will eventually replace manual verification: it’s whether your facility will be an early adopter that gains competitive advantage, or wait until everyone else has already captured the benefits.

If you’re ready to reclaim 50-70% of your administrative time and reinvest it in patient care and growth activities, it’s time to explore real-time insurance verification solutions.

Ready to see how much time and money your SNF could save? Book a personalized demo to discover exactly how real-time insurance verification would work with your current systems and workflows.