Picture this: Your 120-bed skilled nursing facility is hemorrhaging $18,000 every single month. Not from equipment failures, staffing shortages, or maintenance issues: but from something far more insidious. Manual insurance verification is quietly draining your revenue while you’re focused elsewhere.

If you think insurance verification is just a minor administrative task, you’re about to discover why that assumption could be costing your facility hundreds of thousands annually.

The Staggering Reality of Manual Verification Costs

Most skilled nursing administrators dramatically underestimate the true cost of manual insurance verification healthcare processes. Here’s what the numbers actually reveal:

Direct Revenue Loss: Approximately 20% of all claims get rejected for eligibility reasons when using manual verification methods. For a typical SNF processing 200 admissions monthly, that translates to 40 denied claims requiring extensive rework: or worse, complete write-offs.

Labor Premium: Manual verification costs an additional $3.59 per claim compared to automated alternatives. Multiply that across hundreds of monthly verifications, and you’re looking at thousands in unnecessary expenses annually.

But these visible costs are just the tip of the iceberg.

The Hidden Operational Hemorrhage

Time Drain That Compounds Daily

Your admissions team spends an average of 2 hours per patient navigating insurance verification. That’s not a typo: two full hours of:

- Calling multiple payer numbers

- Waiting through automated phone systems

- Logging into different payer portals

- Cross-referencing benefits information

- Documenting findings across multiple systems

With electronic verification reducing this to under 15 minutes per patient, manual processes are stealing 105 minutes of productivity from every single admission.

The Multiplier Effect

When your admissions coordinator spends half their day on verification calls, what else isn’t getting done?

- Follow-up calls to referring hospitals get delayed

- New referral responses slow to a crawl

- Clinical assessments pile up on desks

- Discharge planning coordination suffers

This creates a domino effect that impacts your entire census management strategy.

The Coverage Gap Catastrophe

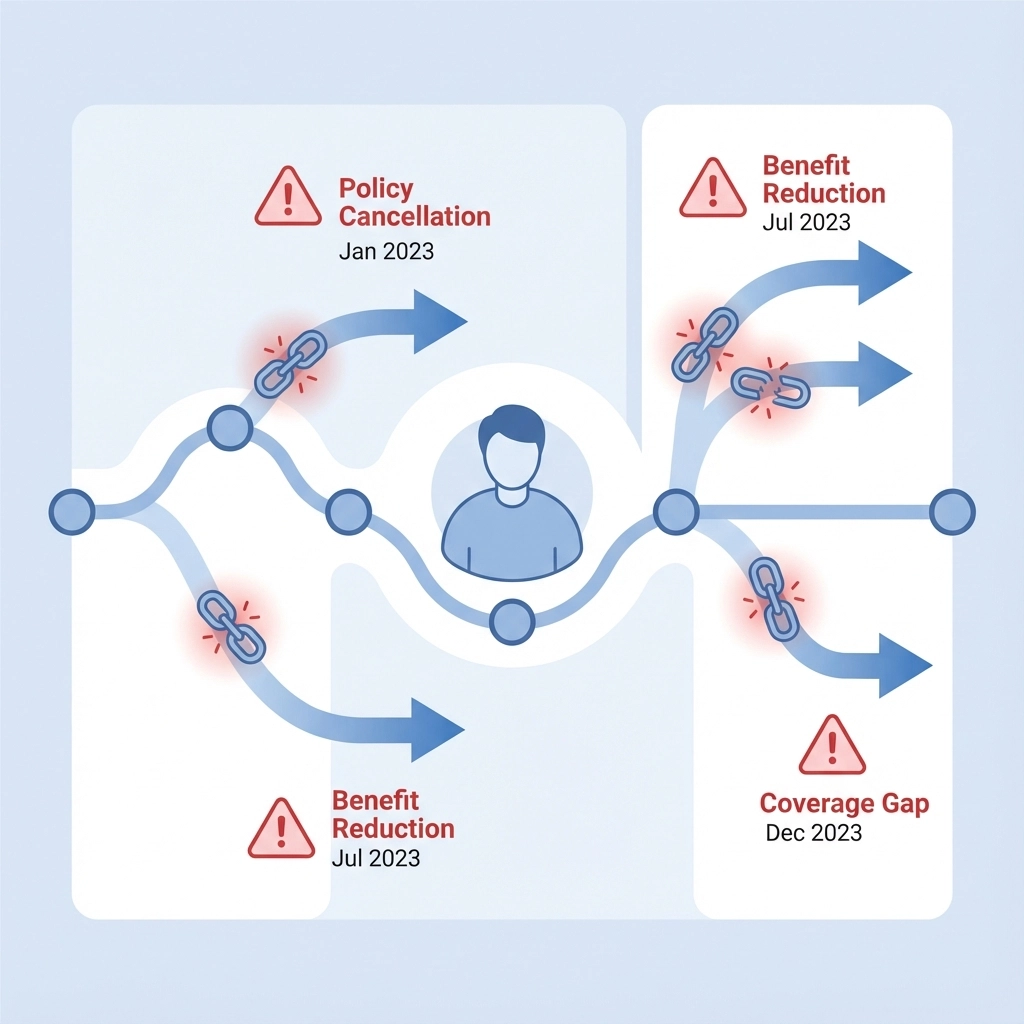

Here’s where manual verification healthcare becomes truly dangerous: timing gaps.

Most manual verifications happen days or weeks before admission. In that window, patients’ insurance status can change completely:

- Coverage gets canceled for non-payment

- Benefits reduce due to plan changes

- Prior authorizations expire

- Medicaid eligibility shifts

By admission day, 15-20% of your “verified” patients arrive with different coverage than what you documented. The result? Claim denials that could have been prevented with real-time verification.

One SNF administrator shared: “We had a patient whose Medicaid was terminated three days after our verification call. We didn’t find out until 30 days into their stay when our first claim was denied. That’s $12,000 in uncompensated care we could have avoided.”

Competitive Disadvantage in Referral Response

In today’s competitive post-acute care environment, response speed determines who gets the referral. Hospitals choose SNFs that can provide immediate admission decisions: not facilities that need 24-48 hours for manual verification.

Consider this scenario: A discharge planner calls five SNFs about a Saturday afternoon referral. Four facilities use automated systems and provide immediate responses. One uses manual verification and promises an answer Monday morning.

Guess who doesn’t get the admission?

Your manual verification process isn’t just costing money: it’s costing market share.

The Quality and Compliance Risk Factor

Manual verification introduces human error at multiple touchpoints:

- Mistyped policy numbers

- Incorrect benefit interpretations

- Missing prior authorization requirements

- Incomplete documentation

These errors don’t just delay payments: they create compliance vulnerabilities. When auditors review your verification processes, inconsistent documentation and missing audit trails become red flags that trigger deeper scrutiny.

Automated systems generate comprehensive digital trails that satisfy auditor requirements while reducing error rates to near zero.

The Cash Flow Impact

Perhaps the most overlooked cost is cash flow disruption. Manual verification delays create a cascading effect:

- Slower admissions due to verification bottlenecks

- Delayed claim submissions from incomplete verification data

- Increased denial rates from verification errors

- Extended accounts receivable from claim rework cycles

Facilities using automated verification report 10-20% reductions in days in accounts receivable. For a typical SNF, that improvement alone can free up $50,000-$100,000 in working capital.

Real-World Transformation Results

The case study data is compelling. After implementing automated insurance verification healthcare, facilities consistently report:

- 35-50% reduction in claim denials

- 30-40% labor cost savings in admissions processing

- 96-98% clean claims rate improvement

- 70-80% faster verification processing

- $7-9 cost reduction per verification

One 120-bed facility documented their complete transformation: from $18,000 monthly in denied claims to $15,000 in monthly savings: a $33,000 monthly improvement in financial performance.

The Technology Solution That Changes Everything

Smart Admissions has revolutionized insurance verification healthcare for skilled nursing facilities across the country. Our AI-powered platform eliminates manual verification bottlenecks while improving accuracy and compliance.

Key capabilities include:

Real-Time Verification: Instant insurance eligibility checks that provide up-to-the-minute coverage information, eliminating timing gaps that cause claim denials.

Automated Prior Authorization: Streamlined PA workflows that identify requirements immediately and initiate approvals without manual intervention.

Multi-Payer Integration: Direct connections to major payers that bypass phone systems and web portals, delivering verification results in under 60 seconds.

Comprehensive Documentation: Complete digital audit trails that satisfy compliance requirements while reducing administrative burden.

Stop the Financial Hemorrhage

Every day your facility continues with manual insurance verification healthcare processes, you’re choosing to lose money. The question isn’t whether you can afford to automate: it’s whether you can afford not to.

The facilities gaining market share are those that can respond to referrals instantly with accurate admission decisions. The facilities losing ground are those still stuck in manual processes that delay responses and increase denials.

Take Action Today

The hidden costs of manual insurance verification are draining your facility’s profitability every single day. But transformation is possible, and it starts with a single conversation.

Smart Admissions has helped hundreds of skilled nursing facilities eliminate verification bottlenecks while improving their bottom line. Our implementation team will analyze your current processes, identify specific cost reduction opportunities, and develop a customized automation strategy that fits your facility’s unique needs.

Don’t let another month of $18,000 losses go by. Schedule your consultation today and discover how automated insurance verification can transform your facility’s financial performance.

Ready to eliminate the hidden costs dragging down your facility’s profitability? Schedule a free consultation with Smart Admissions today and discover how automation can transform your insurance verification process.